If you’re looking for the best way to invest 10,000 dollars, an excellent choice is investing in small cap value stocks. Here is the evidence in favor of this time-tested method of maximizing stock returns.

Value Stocks with a Low Price/Book, Low Price/Earnings, or Low Price/Cash Flow Ratio Beat the Market

These studies come from What Has Worked in Investing by Tweedy, Browne. The idea is that undervalued stocks such as these will increase in price greater than average to reach a fair market price in the long-term. In one study from 1967 to 1984, the decile of stocks with the lowest P/B ratio had a compound annual return of 14.36% vs. 6.06% for the decile with the highest P/B ratio. A study of the P/E ratio from 1966 to 1984 found that the decile with the lowest P/E ratio had a compound annual return of 14.08% vs. 5.58% for the highest P/E ratio. In a study of rolling five year periods of low price/cash flow stocks, the decile with the lowest ratio annually returned 20.1% vs. 9.1% for the decile with the highest ratio. Value stocks are a winning bet.

These studies come from What Has Worked in Investing by Tweedy, Browne. The idea is that undervalued stocks such as these will increase in price greater than average to reach a fair market price in the long-term. In one study from 1967 to 1984, the decile of stocks with the lowest P/B ratio had a compound annual return of 14.36% vs. 6.06% for the decile with the highest P/B ratio. A study of the P/E ratio from 1966 to 1984 found that the decile with the lowest P/E ratio had a compound annual return of 14.08% vs. 5.58% for the highest P/E ratio. In a study of rolling five year periods of low price/cash flow stocks, the decile with the lowest ratio annually returned 20.1% vs. 9.1% for the decile with the highest ratio. Value stocks are a winning bet.

Stocks of Companies with a Small Market Capitalization Beat the Market

Logic says tiny companies have more room to grow into giants than already large companies do. One 17 year study showed that the decile of the companies with the smallest market capitalizations had a compound annual return of 32.8% vs. 13.0% for the largest decile. Multiple other studies worldwide showed this effect as well.

Nobel Prize Winner in Economics Eugene Fama Shows Small Cap Value is a Winner

In 1992, Eugene Fama and Kenneth French published a classic finance article called The Cross-Section of Expected Stock Returns. They challenged previous research that the stock market is essentially unbeatable (Efficient Market Hypothesis) and showed that small stocks tend to beat market averages in the long run, and so do value stocks. Fama and French noted that these stocks performed well without taking on more risk (without having larger fluctuations in value).

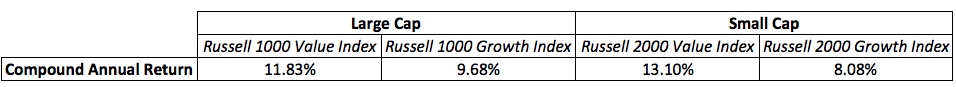

The Brandes Institute published a study analyzing the returns of stocks from 1990 through 2008. They found that the highest stock returns were from small cap value stocks. The chart below summarizes their findings. Notice that small cap value beat everything else.

Executing the Plan with a Low Cost Small Cap Value Fund

Robust research shows that small value stocks outperform the market handily. Also, research shows that low cost funds perform better than funds with higher fees. So, what is the best way to invest 10,000? Financial studies strongly support buying a fund such as the Vanguard Small Cap Value Fund (VISVX). The fund has an expense ratio of 0.24%, which will save you more money in fees than 82% of similar funds.

Below is a chart of the VISVX fund showing that the research is still true; small value stocks perform exceptionally well. Since inception through January 2, 2014 VISVX beat the S&P 500 index 178.86% to 27.08%. Impressive!

Vanguard Small Cap Value Fund

If you enjoyed reading this article, click below to share.

For further reading on personal finance topics, such as answering the question of what insurance do I need, and the best way to invest 5,000 dollars according to a Nobel Prize winner, explore our site.

References

Brown, Christopher H., William H. Brown, Thomas H. Shrager, John D. Spears, and Robert Q. Wyckoff, Jr. What Has Worked in Investing. Rep. Tweedy Browne Company, LLC, 2009. Web.

Fama, Eugene F., and French, Kenneth R. “The Cross-Section of Expected Stock Returns.”The Journal of Finance 47.2 (1992): 427–465. Print.

“Value vs. Glamour: A Study of the Indices.” The Brandes Institute, 2009. Web.